Dear friends, it’s been awhile! After being graced with baby no. 1 in September and taking a few months of leave, we’re back in the seat. If all goes well, these dispatches from the land of Climate Money will become more of a monthly thing.

A cryptic text

Last month, we headed out to Tokyo for the City Tech conference, where we humbly shared a speaking stage with the brilliant Shuo Yang from Lowercarbon and the equally insightful Rainer Sternfeld from Nordic Ninja.

We met climate innovators from all walks of life, including startups, universities, mega-corporates and even the Japanese Cabinet! We walked away with a distinct sense of Japan’s potential as a climate superpower, and a strong hope that they’ll take up the mantle quickly and aggressively.

On the flight back early Thursday morning, with a 6 month old in tow, we started getting cryptic texts from founder friends about Silicon Valley Bank. Pulling money out of SVB because they were running out of cash sounded like an unfunny joke… until we finally got home that evening and the bank run was fully underway.

Today, we’re going to attempt to put SVB’s unfortunate collapse in the context of the broader undercurrents of the capital markets that are affecting real fundraises in real time, especially in climate tech.

More than just the sunset of a ‘climate bank’

A good deal has been written about Silicon Valley Bank’s role as a climate bank due to how many renewable energy projects it financed, specifically in community solar.

But few are talking about the second and third order effects beyond SVB’s role as a renewables lender.

Sure, it’ll take time to fill the SVB vacuum in community solar project lending, but community solar accounts for just 3% of overall solar capacity installed in the US.

And sure, they had a broader renewables lending portfolio that rivaled that of banks like JPM and B of A that were a full order of magnitude larger in assets, implying that they were probably something of a subject matter expert. It’s always sad to lose one of those.

And sure time is temperature, in that the more time it takes the slower moving big lenders to fill the SVB-shaped hole in renewables projects, the more time we’ll be building and using legacy fossil energy.

All this is material, and matters a lot. But, the harder to measure and infinitely scarier impact that the SVB failure will have is on the capital markets themselves. The only thing we have to fear is fear itself, and it turns out that fear is a pretty scary thing.

SVB is still in business as Silicon Valley Bridge Bank, fully backed by the FDIC and safer than ever, and has even recently been shepherded into First Citizens Bank, another regional bank slightly larger than SVB was. But, are you rushing to deposit your funds there?

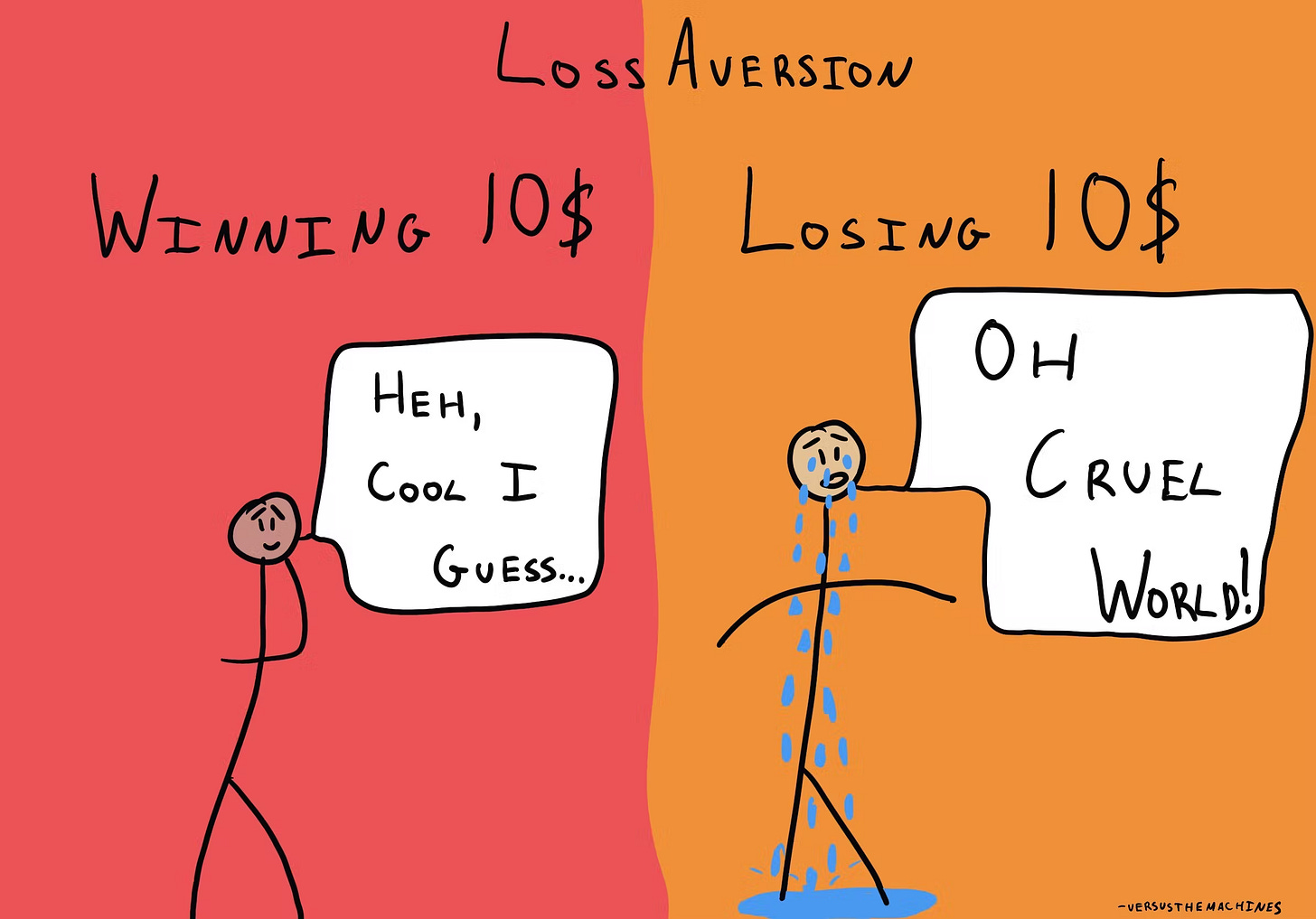

Our relationship with money is rarely rational, both in our personal lives and in business. SVB’s collapse was a terrifying event that seemed impossible until it was happening, and because it was about loss, which triggers twice the emotional pain than an equivalent amount of gain would generate in pleasure, most of us have decided that we’re done. No one wants to go through that terror again.

This fear of loss has spread beyond SVB though, and that’s the real specter down the road of this singular event.

Throughout 2022, many of us have already seen the fear-driven slowdown in fund and deal commitments, even if few are talking about it. Now, with a very important bank failure on top of frowning markets, check writers are even more reticent — and in some cases unable — to commit and deploy capital.

Drying up faster than the Great Salt Lake

Have you heard the news about the Great Salt Lake? It’s on track to go completely dry within as little as five years, affecting all kinds of industries as diverse as shrimp farming to mineral extraction, not to mention eradicating critical habitat for 10 million beings that happen to take the living form of migratory birds. Oh, and the lakebed is full of toxic minerals that will now be blowing in the dry wind.

Just as liquidity keeps birds flying and Utah in business, liquidity also makes marketplaces go round. We find it helpful to think about liquidity in two dimensions:

Transaction volume - how many transactions are happening

Transaction velocity - how fast they’re happening

Volume will be affected as banks have less to lend, tied up as they are in long dated treasuries (SVB wasn’t the only one!) or in commercial real estate loans whose borrowers are riddled with vacancies that don’t pay the bills.

Velocity will be affected as other entities slowly backfill SVB’s loan book, and as every other player in the financial ecosystem from LP to GP decides to extend the diligence window in order to have a closer, more careful look at every deal, with fear casting its long shadow in the background.

And both volume and velocity will be affected as the Fed continues to raise rates, just like it did a little over a week after SVB went into receivership. Today, the federal funds rate is over twice what it was in 2018. Any project being funded by borrowing — including some equity deals coming off a line of credit! — is going to have to be that much more profitable.

In the world of climate money, everyone I’ve spoken with is still in market doing deals, but the bar for committing to a deal is creeping higher and higher. This may translate to needing to see more traction, a lower valuation, or most likely both. A lot of diligence, now slightly more onerous and lengthy than before, is ending in a no.

Eventually, startups that raised at high valuations relative to traction, especially real revenue traction, will have a harder and harder time raising at the terms they want, until ultimately they’re subject to a haircut-or-die situation like the one that recently visited GoodEggs.

Meanwhile, startups that raised conservatively in their last round while betting on a continuation of fast cycles to bridge them to their next round are looking at a ticking clock.

All of the above also applies to VC funds themselves, by the way. Shy LPs make for shyer GPs, compounding the liquidity crunch for startups.

A disproportionate impact borne by climate tech

All this will affect climate tech companies and portfolios disproportionately due to our typically greater capital needs and earlier revenue profiles. Even though climate tech has been the star of the venture and private equity show over the last two years, some of our category’s core attributes are going to make the second order effects of the banking crisis uniquely painful.

Lastly, let’s not forget that there’s a still massive war ongoing in Ukraine, and wars are never good for economic certainty.

Founders: don’t let financing risk creep on you

We often focus on technical risk, execution risk, and go to market risk. But what about financing risk?

Financing risk measures the unhappy likelihood that someone won’t be able to raise the capital they need. Whether you’re the founder of an investment fund or a climate startup, you’re facing the same challenge — everyone’s financing risk is higher than ever, from your friend buying a house to your lead investor raising their next fund to your core portfolio company raising their series A.

The best way to reduce this risk also happens to be the same as how to win any negotiation — by having the ability to walk away from the deal.

How can you make yourself as financing-independent as possible? Thanks to the IRA, there are a bunch of opportunities only available to the climate-mitigating among us.

If you’re a climate startup, and you’re doing something the world wants done, it is imperative that you survive.

Even through injury, pain, amputation, and humiliation. You’ve heard this before, but it may really be time to consider cutting more deeply than you’re comfortable, and sooner than you want.

Seek power in numbers. Supporters are out there, and if they can’t deploy cash, accept their other forms of capital if they offer it: human capital (ie, their labor), social capital (ie, their connections), physical capital (ie, their infrastructure), and intellectual capital (their best ideas).

When an investor says, we can’t invest but we’re here to help — call their bluff. Everyone’s on limited time, but sooner rather than later, one dry lake is everyone’s problem, and maybe also an opportunity if you’re as plucky as I’ve heard the folks in Utah are.

Thank you for taking the time to read with us today, and good luck out there.

Great perspective. Founders need help navigating money (hey don’t we all). And usually 100% of their advice is from one or two existing investors or founder pals. Which is ok but super incomplete. Love your broadening of it all and making some recos around it.

Great. So the technology that might save the planet has to wait 🤔