Climate startups & the “binary risk” of policy & regulation

Plus, join me for a discussion with Anne Hoskins, Chief Policy Office at SunRun, on how startups should navigate the regulatory landscape

Quick note — I’m organizing an interactive discussion featuring Anne Hoskins, CPO of Sunrun in conversation with folks from Carbon180 to talk about how climate startups can interact with — and benefit from — policy and regulation this Friday 4/8 at 9am PT. RSVP here, and more context below!

Hi everyone,

I’ll keep this short and sweet. The past 8 months since starting at Toba to head up our climate investment practice have been simultaneously tough, rewarding and fun. We’ve done a healthy number of deals spanning far-flung categories including energy generation and management, wildfire mitigation, clean cooking fuels, sustainable food, and more — and we’re just beginning to build up momentum :)

Across all of these opportunities, one theme that has emerged is how frequently climate companies encounter questions related to policy and regulation.

While a lot of VCs shy away from the so-called “binary risk” of regulation in their investing, I see things differently for climate tech for two reasons.

1. No risk, no reward

A lot of hard tech companies imply binary outcomes whether or not you’re talking about regulation.* The flip side of binary risk is its upside, which if achieved can be both monolithic and longer-lasting than advantages accrued by all but the biggest internet communications companies.

*Ian Rountree has one of my favorite blog posts on this, where he reframes today’s deep tech upstarts as tomorrow’s industrials. Highly recommend this read if you haven’t seen it.

Image from Ian’s essay, “A financial argument for deep tech.”

2. The quickening drumbeat of climate regulation

While there are ups and downs in the world of climate policy, the unique thing about climate change is that the problem keeps getting uglier — more visible, more painful, and more costly with each passing legislative session or COP convergence.

This gives me a grim confidence: while we may swing on specific legislation, it’s becoming increasingly undoubtable that there *will be* regulation, that much of it will originate outside of the world’s most politicized nations like the US, and that popular support is growing everywhere.

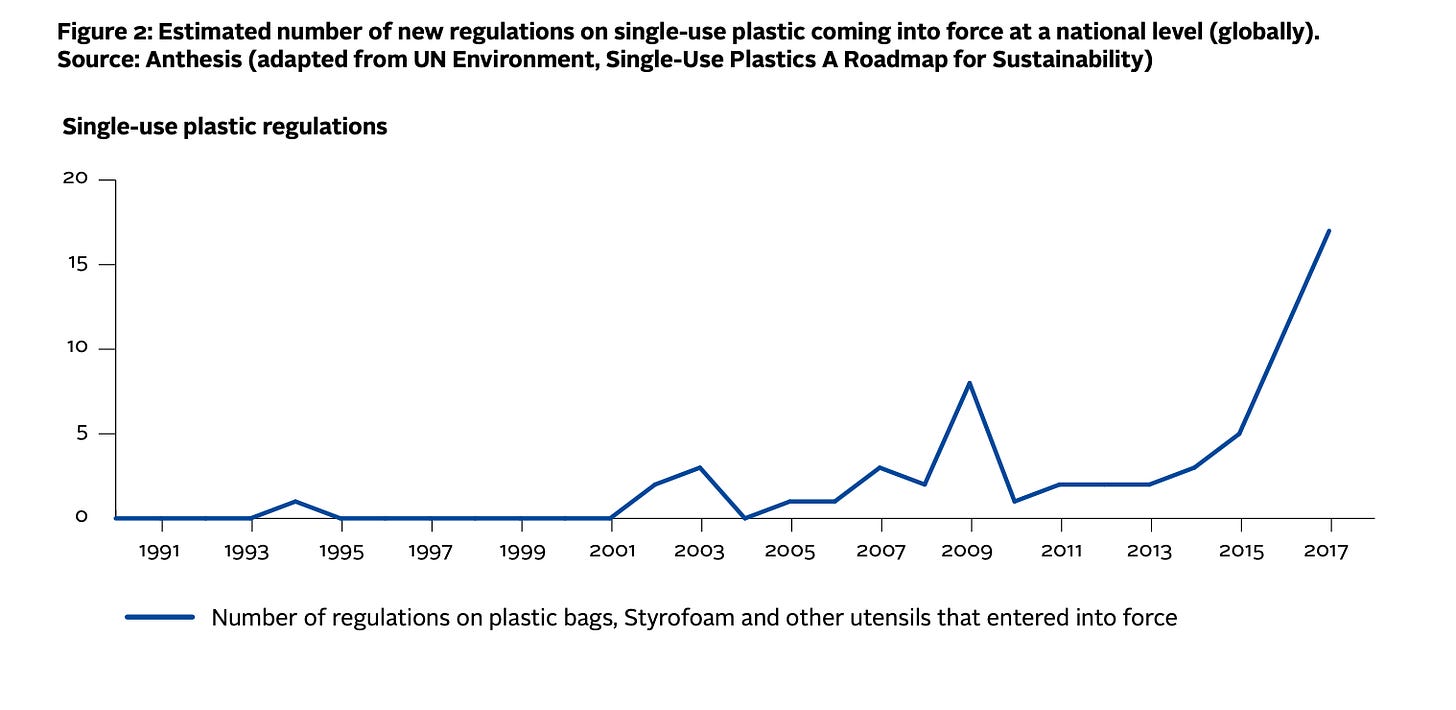

SIDEBAR: an interesting example of this is in the rapidly evolving space around plastics. A recent IPSOS-MORI poll found that over 75% of people *around the world* want to see single-use plastics “banned as soon as possible” (strong language there!).

The most ardent supporters are in Latin America, China, the Middle East and Africa, where anti-plastic sentiment is above 85% and in some cases above 90%. The least strong support? That would be right here in the US and North America.

It turns out that our opinions show in our policies. The US and North America are also conspicuously absent from plastics regulation, along with a few other fellow supply-side nations.

Even so, regulation continues to march forward around the world, without or without American participation.

Images above are from the UNPRI report, The Plastics Landscape, Regulations, Policies and Influencers.

3. High barriers to entry sort out the wheat from the chaff

Navigating policy & regulation is expensive, mind-numbingly detailed, and offers no guarantees on specific outcomes. In fact, it’s not dissimilar to starting a company in a new space, with all the gravity of the status quo crushing down on you.

In other words, it’s a great opportunity space for tough heads that are built to bust through walls, and this happens to align to a core characteristic of the best entrepreneurs and startup operators I’ve had the privilege of knowing.

The companies that can successfully navigate the often unrewarding (but sometimes very rewarding) landscape of policy, regulation, and government budgets, are the same ones that will be most likely to succeed in the face of other obstacles that VCs are more used to underwriting.

We know that policy can be a good friend to climate companies, just like it’s helped plenty of other, dirtier energy companies in the past. “Policy” is also a catch-all concept that’s increasingly too small to really encompass all the ways that government-level decisions can impact and benefit companies that are intentionally making society-level change. It’s not just about the rules, but also about budgetary guidelines, spending, tax credits, penalties and lots more.

All that said, it’s a lot easier to tweet “Climate companies should pay attention to policy!” and a lot harder to know what that actually means —

How should they interact?

When’s the right time to lean in?

Who’s the right person within an organization, or even adjacent to it to own this?

Which other relationships can help to support a favorable policy position? Should investors be a part of this?

And the truth is that the banality of policy and its administrative trappings can be enough to mire down an innovation-focused startup.

Which is why I’m excited to be hosting this Friday’s discussion with Anne Hoskins, Chief Policy Officer at SunRun and former Maryland Public Service Commissioner, and the kind folks from Carbon180. It’ll be (hopefully!) an intimate discussion, and I’d love to meet some of you over Zoom.

9am PT on Friday April 8

Free to attend, RSVP here

You’ll get a Zoom link once you’re confirmed to join

Increasingly, I’m reframing regulation not as a binary risk to be afraid of, but as a big, bulky friend who’s starting to see some of the error of its past ways and consider how it might help the good guys. Legacy fossil energy companies are the ones who should be scared.

My thanks for reading and subscribing,

Susan